child tax credit 2022 passed

The last round of monthly Child Tax Credit payments will arrive in bank accounts on Dec. The child tax credit passed under President Joe Biden has helped 97 of the families with children who.

Faith Leaders Urge Minimum Wage Hike Expanded Child Tax Credit As Congress Nears Recess Kansas Reflector

Qualifying families who didnt file a 2021 tax return still have until mid-November 2022 to claim their remaining Child Tax Credit funds and can use this simple tool.

. The payments stemmed from a temporary enhancement to the child tax credit that Congress enacted as part of the 19 trillion American Rescue Plan Act that passed in March. Total Child Tax Credit. Tax relief is critically.

It will fall to 2000 next year. First your child cant be older than 18 by the end of December 2021. If the current provision making the credit fully available in 2021 expires this family would receive no Child Tax Credit at all in 2022 losing their monthly payment of 550 and.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. However Republican Senators Mitt Romney Richard Burr and Steve Daines. 1 day agoThe bill signed on Tuesday means the tax credit applies to 2022 meaning it can be claimed during tax season next April rather than over a year from now.

Distributing families eligible credit through. Since July the federal government has sent the families of 61 million children monthly payments of 300 per child under 6 and 250 per older child. 2022 Child Tax Rebate PLEASE BE ADVISED.

15 but doubts arise around the remaining amount that parents will receive when they. As Congress failed to agree on a Child Tax Credit extension payments will return to 2000 for 2022. You need to meet certain criteria to qualify for the credit.

Receives 3600 in 6 monthly installments of 600. The federal government and eight states offer child tax credits to enhance the economic security of families with children particularly those in lower- to middle. Instead of the entire credit being claimed on a familys tax.

Increased to 7200 from 4000 thanks to the American Rescue Plan 3600 for each child under age 6. Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17. Stated on August 29 2022 in a speech in Albany Ga.

California Governor Gavin Newsom hasnt been hesitant to open the state coffers to provide for his constituents especially when the federal government is coming up short. The stimulus bill increased the child tax credit to 3600 for children under 6 and 3000 for those 6-17 from 2000. Key Points The American Rescue Plan raised the maximum value of the child tax credit to 3000 or 3600 per child depending on age in 2021.

The application deadline has ended The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into. Families struggling to make ends meet received much needed relief in 2021 through. Who Qualifies for the Child Tax Credit in 2022.

Child Tax Credit Checks Now Being Sent To Families Connecticut House Democrats

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

What Is The Child Tax Credit Tax Policy Center

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

What You Need To Know About The Earned Income Tax Credit In 2021 Forbes Advisor

Stimulus Update House Passes Bill Extending Payments Into 2022 Wkrc

Momsrising Org Tell Your U S Senators Continue The Monthly Ctc Tax Credits Pass Bbb Now

The Child Tax Credit Research Analysis Learn More About The Ctc

Child Tax Credit What Can Happen In 2022 Fingerlakes1 Com

Will Monthly Child Tax Credit Payments Continue In 2022 Their Future Rests On Biden S Build Back Better Bill

Taxes Archives The Frugal Daddy

Expiration Of Child Tax Credit Payments Reflects Poorly On Democrats Poll Says Fox Business

Child Tax Credit Schedule 8812 H R Block

Child Tax Credit What Can Happen In 2022 Fingerlakes1 Com

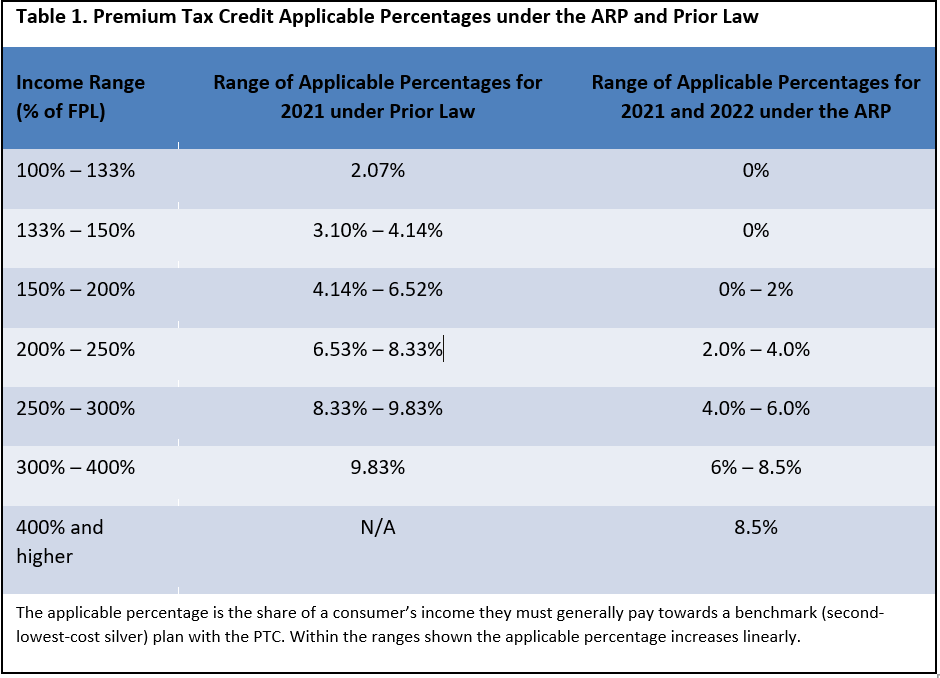

The American Rescue Plan S Premium Tax Credit Expansion State Policy Considerations

Kristie Weiland Stagno Building Back For Justice Requires Expanded Child Tax Credit Triblive Com

Child Tax Credit Has California S Ab 2589 Bill Proposal Passed Gobankingrates

Child Tax Credit 2022 Why Did Families Only Receive Payments For Six Months As Usa

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities